Apple now provides a savings account that can earn over 4% interest and is managed using its iPhone app.

Although customers must have a valid Apple Card, setting up the savings account is simple. Goldman Sachs is in charge of handling the accounts.

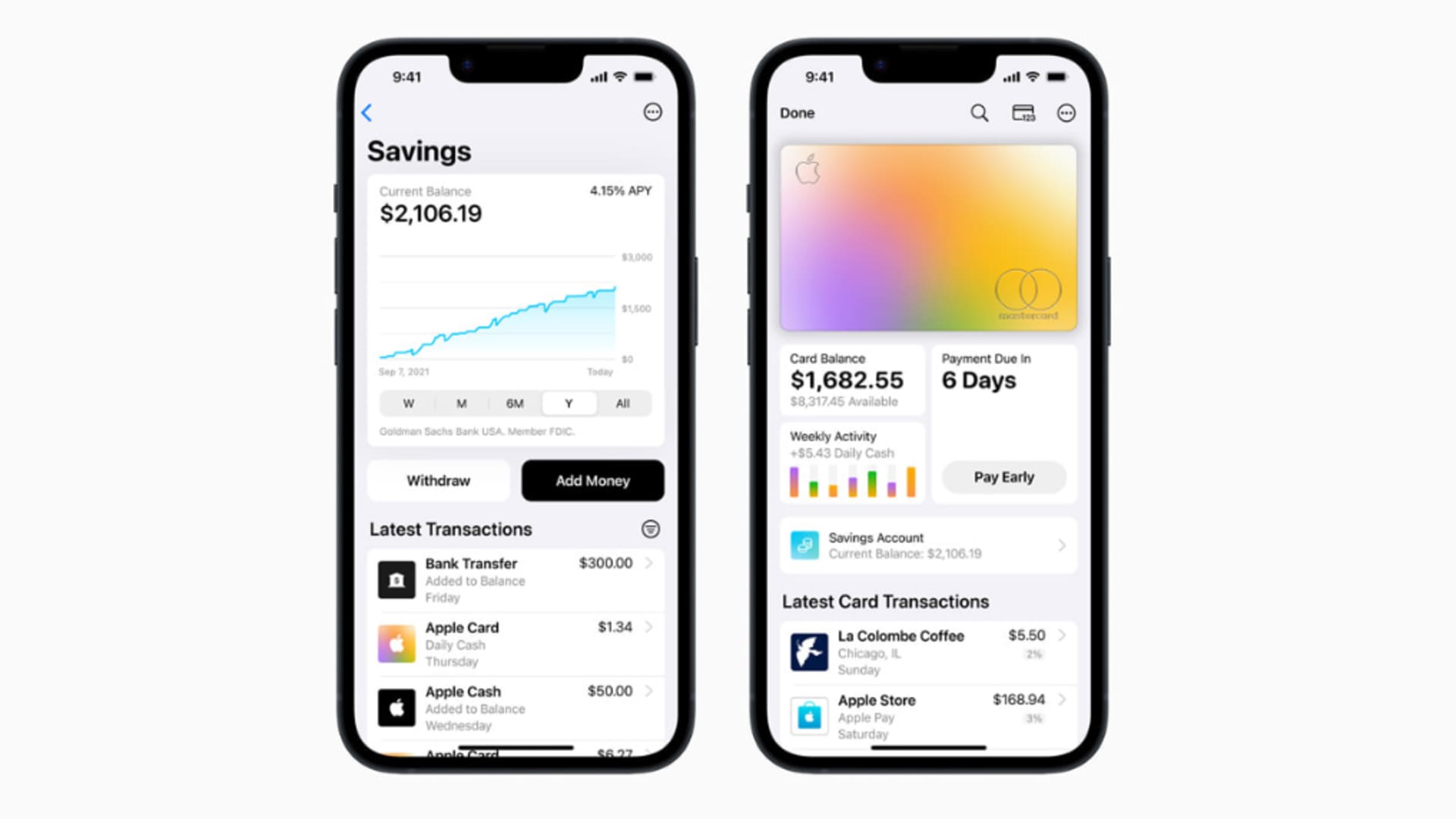

Once the account is established, Apple Cash, which is the cash-back incentive for using an Apple credit card, may be automatically put into the interest-bearing savings account. In case they wish to use it or gift it to a friend, users can also transfer money from their savings account to their Apple Cash account.

Users can contribute more money to their savings accounts to get the current daily compounded yearly income of 4.15%. As interest rates change over time, the yield will fluctuate.

The FDIC insures deposits made to the Apple Savings account up to $250,000. All American owners of Apple Cards may now access the functionality from within the Wallet app on Apple devices.

What you need to know is as follows:

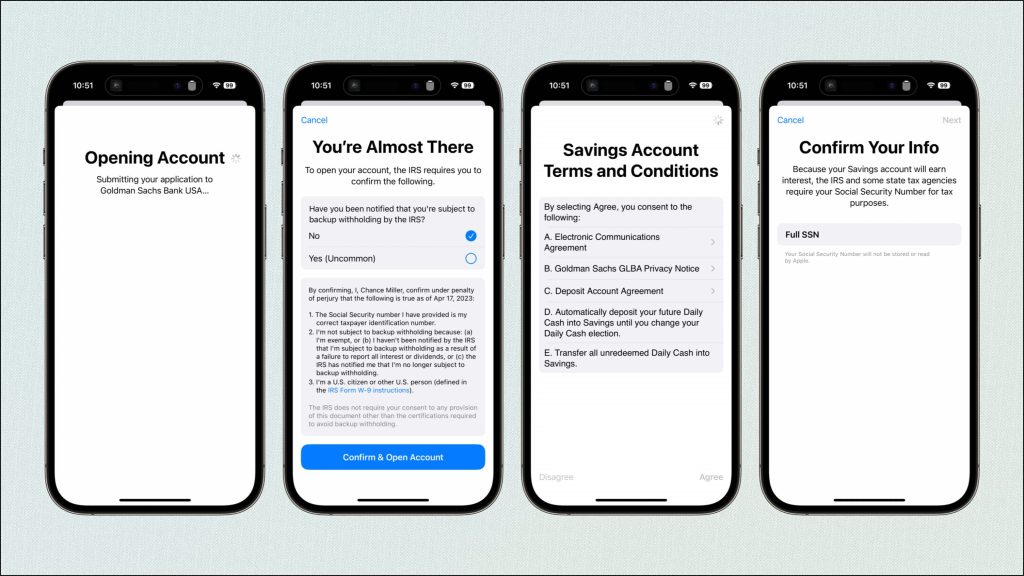

How to register

Activate your Apple Card on your iPhone.

Tap on your Apple Card in the Wallet app after opening it.

Choose Daily Cash by clicking the button with three dots in the top right corner. Alternatively, the home page may have a promotional button for opening a savings account.

Observe the directions. You will be required to sign many agreements and provide your Social Security number.

If you don't want to use the money right away or want to give it to a friend, you may transfer it back to your savings account. Apple will start putting your Apple Card earnings back into your savings account by default.

You can transfer funds to your savings account from a connected bank account.

You probably already have a bank account set up to accept payments if you have an Apple Card.

Activate the Wallet App. Your savings balance should be displayed on a button on the first page.

To add money from your linked bank account, hit the Add Money button on the savings page.

Additionally, you can transfer money from your savings account to the Daily Cash account or the associated bank account.

There is no restriction on the number of withdrawals or deposits a user may make to their savings account.

Related Posts

.jpg)