Global stocks plunged for the second consecutive day on Friday as concerns over a global recession intensified following U.S. President Donald Trump’s sweeping tariff proposals. The sell-off worsened after China announced it would impose additional tariffs of 34% on American goods.

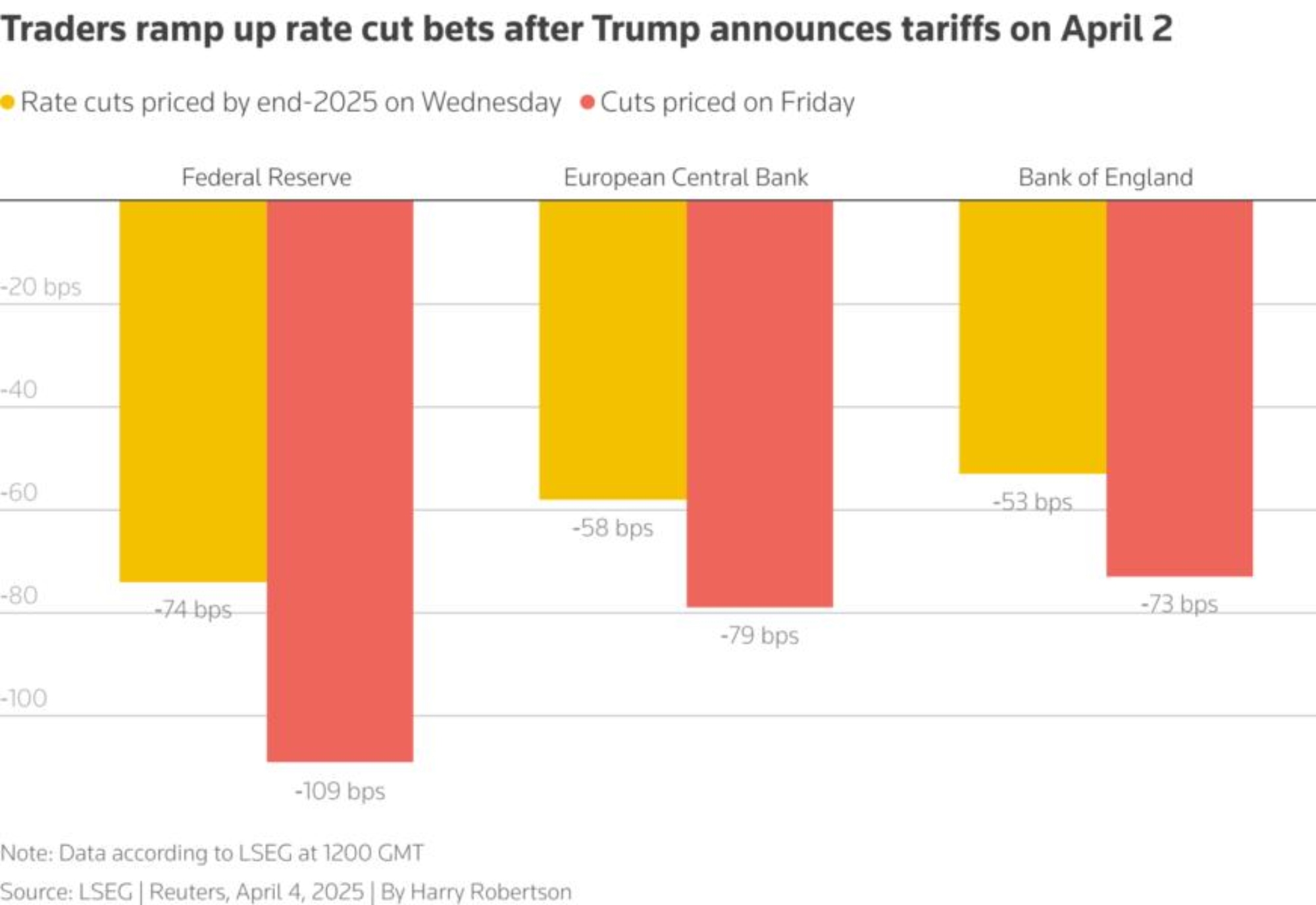

Oil prices also dropped, as investors grew increasingly anxious about global economic growth, seeking refuge in government bonds and the Japanese yen. At the same time, market participants heightened their expectations of significant rate cuts from the Federal Reserve and other major central banks.

On Wednesday, Trump imposed a 10% tariff on most U.S. imports and higher levies on several countries, creating the most significant trade barriers in over a century. China's retaliatory measures on Friday confirmed fears that a full-scale global trade war was underway.

"The market is doing one thing: pricing in a global recession," stated George Saravelos, Global Head of FX Research at Deutsche Bank.

Despite data showing that the U.S. economy added more jobs than expected in March, investor sentiment remained grim.

The STOXX 600 in Europe fell by 4.2%, continuing its slide from Thursday, and was on track for its largest daily drop since the 2020 COVID-19 pandemic. Japan's Nikkei 225 dropped 2.8% overnight, marking its second consecutive session of losses.

U.S. S&P 500 futures plummeted 2.5% after the cash index fell by 4.8% on Thursday — its largest drop since 2020 — while Nasdaq futures were down 2.6%.

"If we start seeing negotiations or Trump scaling back on some of these tariffs, that’s the only plausible way the sell-off could ease," said Aneeka Gupta, Equity Strategist and Economist at WisdomTree. "But for now, that seems highly unlikely."

The VIX index, a key gauge of expected volatility in U.S. stocks, surged to its highest level since August, reaching 38.

Brent crude oil fell to a four-year low, dropping below $65 a barrel.

.jpg)